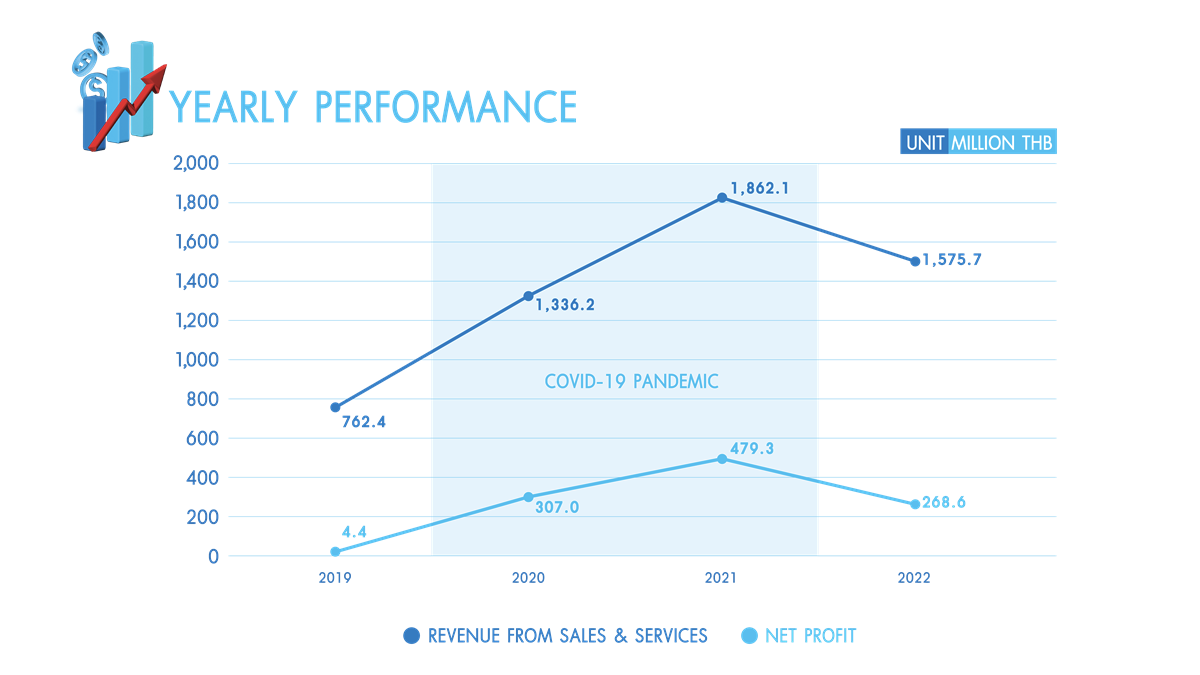

On February 27, 2023, Asiasoft Corporation Public Company Limited announced their operating performance for the year 2022. The company had a total revenue of THB 1,575.7 million and a net profit of THB 268.6 million, which decreased by 15.4% and 44.0%, respectively, compared to the previous year. The main contributing factors were the global economic slowdown and a “corrective year” after two years of growth due to the COVID-19 pandemic. As a result, Newzoo, a global gaming market survey company, predicted a 4.3% decline in the global games market for 2022 compared to the previous year. The revenue from new games that the company launched was also not as expected. Although the company managed to launch nine new games (eight mobile games and one PC game), exceeding their initial plan of seven games, the revenue from these new games was not as high as anticipated. However, compared to 2019, before the outbreak of COVID-19, the company still showed impressive revenue growth of 107% and net profit growth of 6,005%, in line with the global market trend.

Regarding the operating results of 2022, the Board of Directors has approved the payment of an annual dividend of 0.53 baht per share, representing a dividend payout ratio of 78% based on the 2022 net profit. In addition, an interim dividend of 0.30 baht per share was paid in September 2022, with an additional approval of 0.23 baht per share. The Company will determine the list of shareholders entitled to receive dividends (Record date) on March 29, 2023, and the dividend payment date will be on May 9, 2023.

Mr. Gerry Ung, the Chief Financial Officer (CFO) of Asiasoft Corporation Public Company Limited, stated that the company’s overall profit in 2022 slowed down in each quarter. In quarter 4, the net profit was THB 9.8 million, which accounts for 3% of the total revenue. The main factors affecting this were the start of paying corporate income tax, as tax credits arising from accumulated losses in the past were fully implemented in quarter 3, resulting in the quarter 4 tax payable. Additionally, the fluctuation of the USD currency caused a forex loss from USD cash holdings of THB 20 million. The revenue structure in quarter 4 was mainly from the Mobile platform, accounting for 27%, which resulted in an increase from the previous quarter. As a result, the cost of channelling fees through the AppStore and Play Store channels increased, including marketing expenses in a high proportion compared to revenue. The launch of games was not as successful as expected, which also contributed to the slower growth in profits.

Despite these challenges, Mr. Gerry Ung remains optimistic about the future. He emphasizes that the company has already started implementing various strategies and preparations to adapt to the changing gaming industry landscape. Furthermore, he notes that Asiasoft’s new business plans, which expand into other industries, will contribute to the company’s resurgence, and generate significant profits in the future. Therefore, the company is confident that it will grow again this year and capitalize on new opportunities.

Mr. Kittipong Prucksa-aroon, the Managing Director of Asiasoft Corporation Public Company Limited, shared that the company has been working on a strategy to expand its business beyond the traditional online game industry since the beginning of 2022. The business has been restructured into four groups, and the company is making progress in each of them. For example, the Venture Capital business group is planning to sign an MOU to study the feasibility of investing in Buzzebees Company Limited, a leading provider of integrated CRM platforms in Thailand. The company is also interested in investing in other technology and innovation businesses such as Metaverse, MarTech, EduTech, etc.

In addition, the Blockchain & Innovation Technologies business group has established a joint venture with the Bitkub group called KubPlay Entertainment Company Limited, and they are in the process of preparing to apply for a utility token public offering (ICO) to support the usage of the Astronize platform ecosystem. An advisor (ICO Portal) has been appointed to submit documents to the SEC.

Furthermore, in the Online Game Publishing business group, the company is focusing on maintaining its customer base, along with continuously launching new games. They are also using MarTech, such as a Customer Data Platform (CDP), to increase marketing efficiency, accuracy and reduce marketing costs in the long run.

Finally, Mr. Kittipong Prucksa-aroon expressed his gratitude for the continued support and confidence in the company. The company remains committed to delivering value to all stakeholders and driving sustained growth.